How to Finance Your Dream Home

Fresh New Jersey real-estate market insights, luxury renovation know-how,

and expert tips to level-up your next property investment.

Introduction

How to Finance Your Dream Home

Introduction

Owning your dream home is one of the most significant milestones in life. It’s a space where memories are created, a sanctuary for your family, and a reflection of your aspirations. However, the path to homeownership often feels daunting due to financial complexities. This guide will walk you through the steps to make financing your dream home manageable and achievable.

Whether you are buying your first home, upgrading to a luxurious property, or building from scratch, careful planning and knowledge about financing options are crucial. Let’s dive into the essential steps to help you move closer to your dream home.

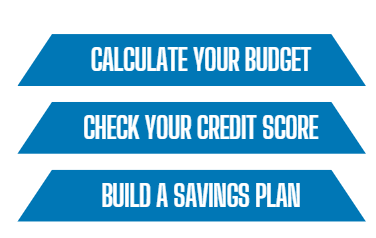

Assessing Your Financial Situation

Before you start the journey to buy your dream home, it’s important to take a close look at your finances. This will help you see what you can afford and if you need to make any changes to reach your goal.

- Calculate Your Budget:

- Assess your monthly income, savings, and expenses.

- Consider how much you can comfortably allocate toward a mortgage payment.

- Check Your Credit Score:

- Your credit score plays a critical role in securing a loan and determining interest rates. Aim for a score of 700 or higher for the best rates.

- Review your credit report for errors and take steps to improve your score if needed.

- Build a Savings Plan:

- Save for a down payment. Most lenders require 5-20% of the home’s purchase price.

- Factor in closing costs, typically 2-5% of the purchase price, and an emergency fund.

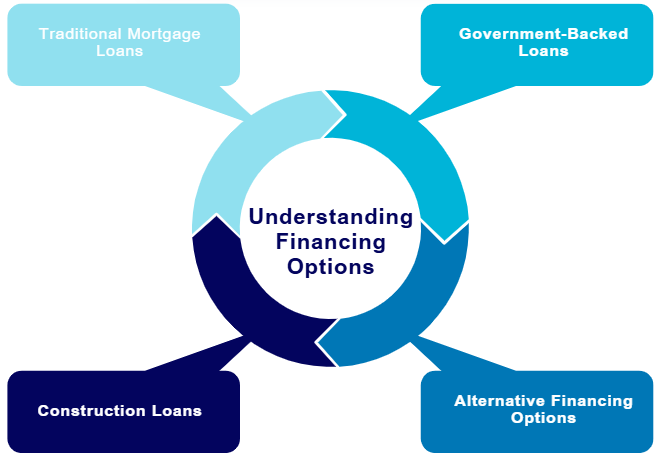

Understanding Financing Options

There are several ways to finance a home. Each option comes with its pros and cons, so choosing the right one depends on your financial goals and circumstances.

- Traditional Mortgage Loans:

- Fixed-Rate Mortgage: Offers predictable monthly payments over 15-30 years.

- Adjustable-Rate Mortgage (ARM): Starts with a lower interest rate that adjusts over time, depending on market conditions.

- Government-Backed Loans:

- FHA Loans: Ideal for first-time buyers with lower credit scores and smaller down payments.

- VA Loans: Available to veterans and active-duty military personnel, often requiring no down payment.

- USDA Loans: Designed for rural and suburban homebuyers, offering competitive interest rates and no down payment.

- Construction Loans:

- If you’re building your dream home, a construction loan covers costs during the building phase. These loans typically convert to traditional mortgages after completion.

- Alternative Financing Options:

- Seller Financing: The seller acts as the lender, offering flexible terms.

- Rent-to-Own: Lease a property with the option to buy after a set period.

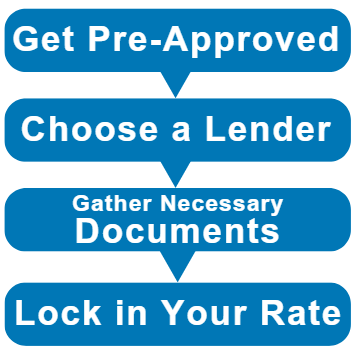

Securing a Mortgage

Securing a mortgage is one of the most critical steps in financing your dream home. Here’s how to navigate the process:

- Get Pre-Approved:

- A pre-approval letter shows sellers you’re a serious buyer and helps you understand your borrowing capacity.

- Choose a Lender:

- Compare lenders to find the best interest rates, loan terms, and customer service.

- Gather Necessary Documents:

- Proof of income (pay stubs, tax returns).

- Credit history.

- Asset documentation (bank statements, investment accounts).

- Lock in Your Rate:

- Once you’ve chosen a lender, lock in your interest rate to protect against market fluctuations.

Tips for Reducing Costs

Owning a dream home doesn’t have to break the bank. Here are strategies to reduce costs:

- Shop Around:

- Compare multiple lenders to find the most competitive rates and terms.

- Negotiate Closing Costs:

- Ask your lender or real estate agent about potential discounts or seller contributions.

- Buy Down Your Rate:

- Consider paying points upfront to secure a lower interest rate.

- Explore First-Time Buyer Programs:

- Many states and local governments offer grants and assistance programs to make homeownership more affordable.

- Consider Less Expensive Markets:

- Look at up-and-coming neighborhoods or surrounding areas that offer more value for your money.

Staying Financially Secure

Once you’ve purchased your dream home, maintaining financial stability is key:

- Create a Homeownership Budget:

- Account for ongoing expenses like utilities, maintenance, and property taxes.

- Build an Emergency Fund:

- Save 3-6 months’ worth of living expenses to cover unexpected costs like repairs or job loss.

- Refinance Strategically:

- If interest rates drop, consider refinancing to lower your monthly payments or shorten your loan term.

- Protect Your Investment:

- Invest in homeowner’s insurance and consider additional coverage for natural disasters.

Conclusion:

How Prawdzik Properties Can Help

At Prawdzik Properties, we understand that financing your dream home can feel overwhelming. That’s why we’re here to guide you every step of the way. Whether you’re buying, building, or selling a property, our team is dedicated to making the process seamless and stress-free.

We offer:

- Expertise in finding the best financing options for your needs.

- Connections to trusted lenders and professionals.

- A portfolio of homes designed to meet diverse tastes and budgets.

- Transparent, client-focused services to help you achieve your goals.

Your dream home is closer than you think. Let Prawdzik Properties help you turn your vision into reality. Contact us today to begin your journey to homeownership!